Etoro Who To Copy: Ultimate Guide

Choosing who to copy with your funds can be scary. This guide explains what to look for in a popular investor.

There are many benefits to copying a popular investor but how do you decide who to copy?

1. Strategy

A clear and well defined investment strategy is very important.

This is the bare minimum for any professional investor. You don’t want someone messing around with your hard earned money.

You can usually find an investors strategy in the bio of their profile page. Sometimes investors also have pinned posts that you should also read.

It’s very important that you understand their strategy. Don’t get fooled by big words or investment terminology.

If you don’t understand it don’t copy them.

If you come across terms you don’t understand spend time researching them. You can even ask the investors themselves to clarify anything in the comments of their posts.

Knowing their strategy will make it alot easier to trust them. The last thing you want is to be constantly checking on your copy anxiously watching their performance.

Understanding their strategy also means you know where they sit in your portfolio. I will write another post later on about building a social portfolio.

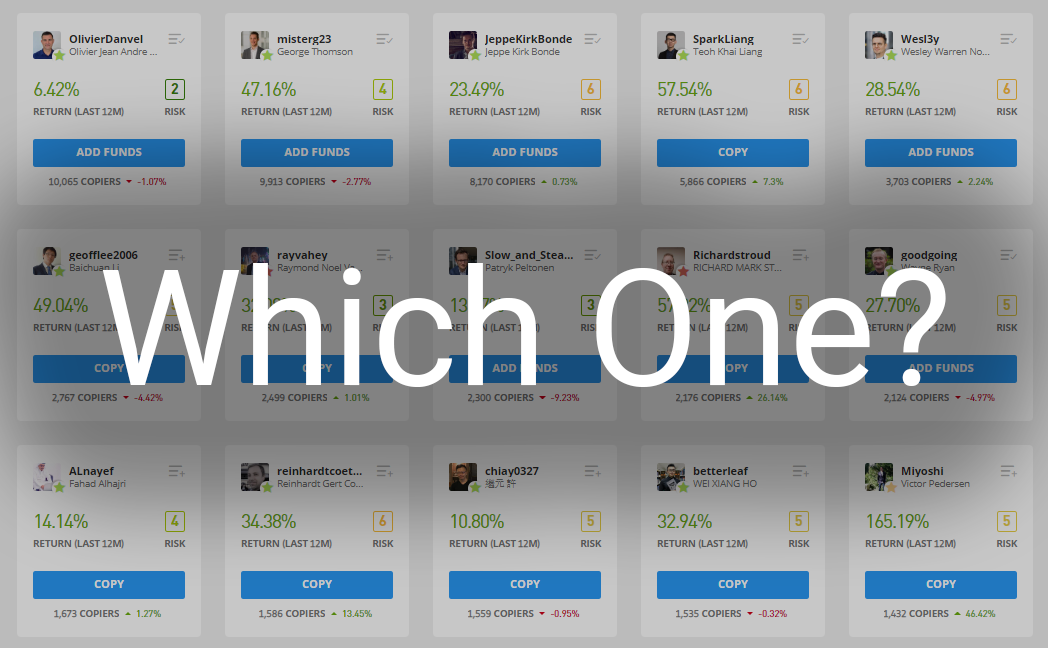

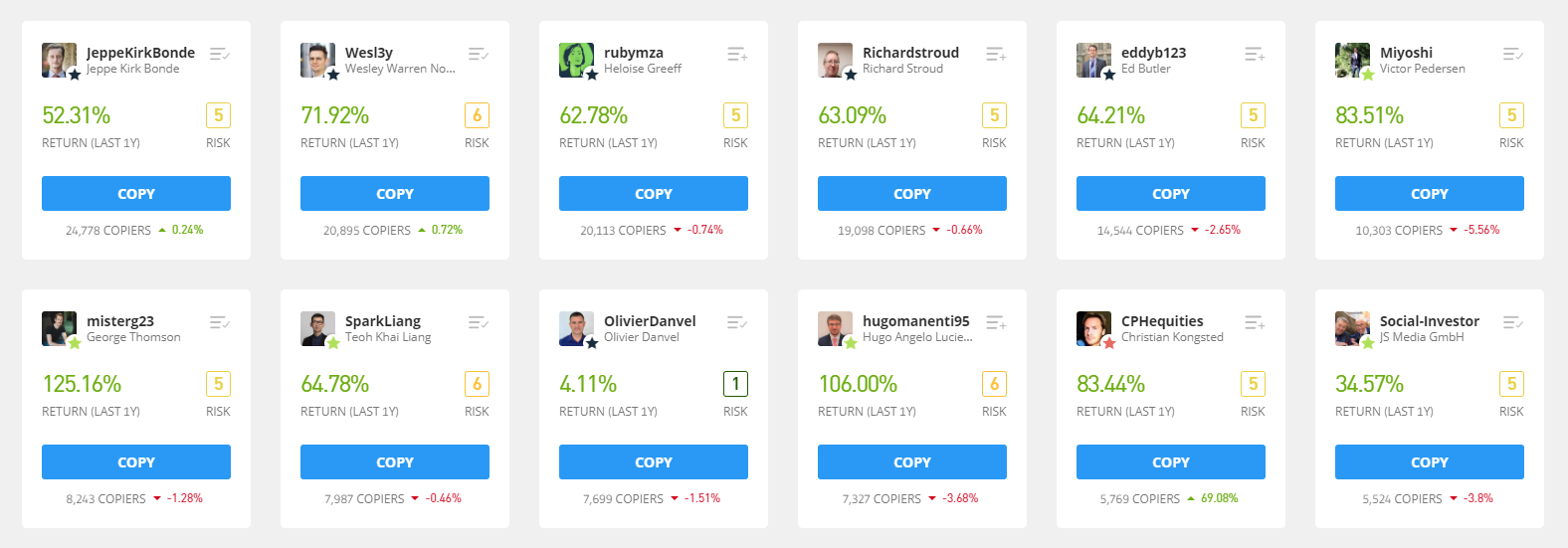

2. Start with the most copied

The best place to start looking for who to copy is the most copied list. They’re the most copied for a reason right?

It takes a very good track record and solid strategy to get to the top of the most copied list. It makes it the best place to start

3. Communication

Communication is the most important factor for me.

I like to know the thought process behind taking or closing trades. It gives me confidence that my money is being put to good use.

A sign of a good investor is that you will learn from what they post. I have learnt loads from the investors I copy.

Another good sign is when an investor admits to their mistakes. Good investors will reflect and learn from their bad trades.

A monthly post about the performance of their portfolio is the bare minimum. Good communicators will post regularly on and off Etoro about their thinking and current positions.

Good Examples:

Wesl3y - Posts thoughtful pieces on Etoro as well deeper dives into subjects and companies on Youtube.

https://www.etoro.com/people/wesl3y

https://www.youtube.com/channel/UCZfQYjz2u2qvwD1cZ590oqA

Jaynemesis - Keeps copiers updated with posts on Etoro, longer discussions with vlogs on Youtube and is also very active on Twitter.

https://www.etoro.com/people/jaynemesis

https://www.youtube.com/channel/UC3MuF305H8Rv-giCcR5ILLg

https://twitter.com/jaynemesis

4. Experience

Having one lucky month does not make someone a good investor.

I would even say that having 12 lucky months does not make someone a good investor. You should be looking for investors that have experience in years not months.

Basically the more the better.

Time evens out the flukes and lucky breaks. If an investor is able to deliver solid returns over many years it shows they are professional with a well drilled strategy.

5. Minimum copy size

Although you can copy an investor with just $200 you could miss some of their trades.

When you copy an investor any trades will be copied in a proportional amount for you. So if they open a buy position in Apple using 10% of their portfolio, your copy will open the same position using 10% of what you copied with.

There is a minimum proportional trade size which is currently $1.

This means if your copied trade equals less then $1 in size for you it won’t be opened.

It depends on the investor’s strategy if it will become a problem. Most investors list in their profile page bio if they recommend copying with more than the $200 minimum.

Learn more here: https://www.etoro.com/customer-service/help/38417770/why-are-my-trades-not-being-copied/

6. Set your expectations

This isn’t exactly something to look for in a popular investor, more something to understand yourself. But still very important when copying anyone.

It’s very easy to feel disheartened when you see your copy go into the red. Unfortunately this is likely to happen during your copy.

Popular investors do their best to diversify and hedge their portfolios so that they can deliver consist returns.

But trading is not simple and just like how the overall stock market goes up and down so do Investor’s portfolios.

Even the best investors in the world cannot achieve linear growth they also experience ups and downs. Time is the only thing that evens them out.

When you copy an investor you should be looking at it as a long term investment. This means not focusing on the results of a few days or weeks.

Instead you should set a stop loss you are comfortable with and only evaluate the results every couple of months.

This also applies to the returns you are expecting from your copy. You will be disappointed if you are expecting an investor to double your money in a few days.

I hope you like this guide :)

What’s the most important factor for you? list what you look for in an popular investor in the comments below