How does copy trading work? (Step by step guide)

The reason you invest your money is so that it can grow. The stock market is one of the most performant and popular investments anyone can make. Thanks to retail investment services there is basically no barrier to entry. You don’t need alot of savings to get started. You can start with whatever you spare.

Once you’ve figured out how much you can invest how do you get it into the stock market? There are alot of methods you can choose from. You can pick stocks to buy yourself, invest into an exchange traded fund or even let a robot pick stocks for you! There are many different methods each with their own risk/reward and effort required from you. One of the most recent method is copy trading.

Copy trading let’s you automatically copy the trades/investments of the person you’re copying. This process can be confusing so we’ve made this step by step of how it works :)

Start copying

For our examples we’re going to use a new investor Jack, who is going to copy the popular investor Jane.

Before Jack starts the copy let’s look at what their portfolios look like. Jack currently has a balance of $1000 and no open positions. We won’t be able to see exactly how much Jane has in her account but we can see how it’s distributed. We can see Jane currently has 50% of her portfolio in cash. The rest of her portfolio is spread evenly across two positions in Apple and Tesla.

Jane has a proven track record so Jack has decided to start copying Jane with his full $1000.

This is what Jack’s portfolio looks like after he starts copying:

On the left is what Jack’s portfolio now looks like. A copy of Jane has been added to the portfolio with the $1000.

On the right is what this actually means. You can see the the $1000 has been used in the same proportions as Jane’s portfolio. 50% of the $1000 is still kept in case and the other 50% has been invested into Apple and Amazon.

Investor opens or closes a position

After Jack starts copying, Jane sees a new opportunely in the market she wants to take advantage of.

Jane uses half of her balance to open a new position in Tesla.

This is of course automatically copied in Jack’s portfolio. It uses the cash reserves of the copy to open a new Tesla position. Jack didn’t have to add any new funds to his account which currently has a balance of $0.

This is what the portfolios now look like:

The proportions of the new position was kept in line with those of the investor. The new Tesla position was opened with $250 which was half of the balance of the copy.

The same goes for any positions the investor closes. The value of the position is returned to the balance of the copy.

Adding funds

Jane is performing very well and Jack can see his money growing. Next payday he wants to add more funds to his Jane copy so it can grow even more.

The process for this is quite simple. Jack does not need to start a new copy of Jane with the new money. He can just add the new funds to the existing copy.

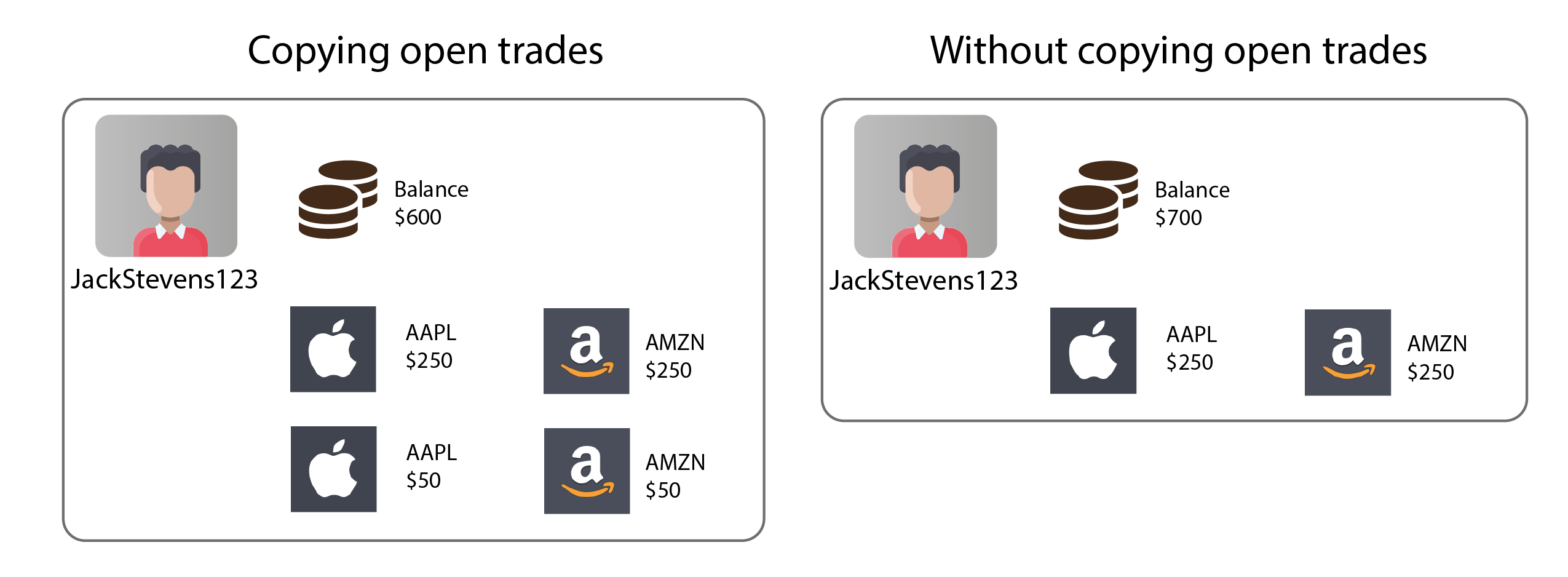

Jack has an options when he does this, he can decide whether to copy open trades or not.

When added funds without copying open trades the new funds get added to the spare balance of the copy. They will then be used the next time the investor opens a new position.

When copying open trades the platform will open new positions to keep the copy in the same proportions as the investor.

The graphic below shows how the option works when Jack added $200 to his copy of Jane:

Whether you copy open trade or not depends on the strategy of the investor. They will usually tell you if you should or not in their profile description.

Removing funds

You can remove funds from the copy at anytime.

But you can only remove funds from the available balance of the copy. Any funds locked up in open positions cannot be removed.

Closing a copy

Closes a copy will stop the copy and return all the funds to the main balance of your account.

Any open positions in the copy will be closed at their current market price. You may see them set as pending if the market is closed and they’re not able to close the position. They will be closed the next time the market is open.